Under a new ruling issued by federal government agencies, health payers may be able to reimburse emergency care providers whatever fee deemed applicable.

As the year is coming to a close and many are getting ready to

celebrate the holidays, it is important to look toward the coming year

and prepare for healthcare insurance trends expected to impact the

market. Over the last several years, both the Patient Protection and

Affordable Care Act along with the Health Information Technology for

Economic and Clinical Health (HITECH) have made significant changes for

the healthcare industry.

As the year is coming to a close and many are getting ready to

celebrate the holidays, it is important to look toward the coming year

and prepare for healthcare insurance trends expected to impact the

market. Over the last several years, both the Patient Protection and

Affordable Care Act along with the Health Information Technology for

Economic and Clinical Health (HITECH) have made significant changes for

the healthcare industry.

It’s important to understand how various health reform initiatives

will continue impacting the health payer market. Below we outline four

healthcare insurance trends that payers should watch out for in 2016.

ACOs will consolidate and continue to bring cost savings

Today, Accountable Care Organizations (ACOs) are becoming a real

stronghold throughout the healthcare industry, as these partnerships are

bringing more providers as well as payers to discuss and plan ways to

garner cost savings.

In an interview,

Ted Schwab, Managing Director at Huron Healthcare, stated, “What folks

have overlooked is that the ACO movement has been an organizing force

throughout the healthcare industry and it’s got hospitals and doctors

for once under the same umbrella talking about efficiencies, clinical

protocols, and ways to save costs.”

“There are now north of 700 of these organizations in the United

States of America,” Schwab explained. “If you think about where the

industry has been for the last 100 years, it’s been a mom-and-pop

fragmented industry. Now you have 700 organizations with folks at least

talking to each other. It’s going to take a while. We’re at the very

beginning of this movement and I could not be any more encouraged.”

“I think that both the Medicare Shared Savings Program and the ACO

industry will evolve. We will see a massive consolidation of ACOs just

like we’re seeing consolidation in the rest of the healthcare industry

so folks can get to scale and use that scale to leverage efficiencies.”

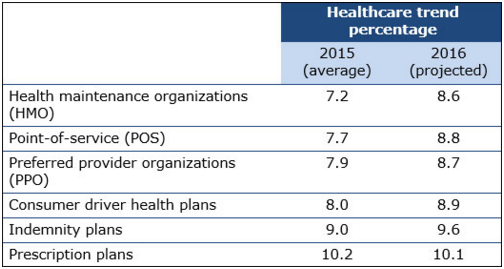

Healthcare premiums expected to rise

When it comes to claims reporting and medical billing, health

insurers are reporting that premiums will rise above regular inflation

rate in 2016, according to the Spring Healthcare Trend Survey from Wells Fargo Insurance. Out of all healthcare insurance trends, this is an important one to watch out for.

The reason for the increase in healthcare premiums many are reporting

is due to predictions that medical claim costs will rise by 7 to 10

percent next year. Additionally, rising costs in drug prices are also

leading to bigger premiums for employers and consumers, the survey

found. Healthcare claims trends are also expected to rise for the

majority of products in 2016.

Emergency care reimbursement will lack restrictions

Under a new ruling issued by federal government agencies, health

payers may be able to reimburse emergency care providers whatever fee

deemed applicable. The Department of the Treasury, the Department of

Labor and the Department of Health and Human Services issued a final ruling that states insurers can pay physicians working in emergency rooms “whatever they like,” according to a press release from the American College of Emergency Physicians (ACEP).

Emergency care providers are likely to be against this type of

legislation especially since they have provided adequate feedback to the

Centers for Medicare & Medicaid Services over the years. ACEP is

currently considering taking legal action against this new ruling, as it

would heavily favor health payers ahead of emergency care providers and

the patient community.

The ruling establishes that within states that have prohibited

balance billing, minimum payment standards will not be required. Balance

billing is essentially a practice in which health plans pay a very low

reimbursement rate and physicians bill patients for the unpaid balance.

Research shows that many patients today are foregoing obtaining

medical care until it becomes a complete emergency because of high

deductibles or out-of-pocket expenses. This is a significant problem and

legislation that allows payers to cover whatever costs they deem

necessary would only exacerbate the issue. When it comes to healthcare

insurance trends, this one is likely to negatively impact emergency care

providers in the coming year.

“This new ruling will significantly benefit health insurance

companies at the expense of physicians, because they know hospital

emergency departments have a federal mandate to care for everyone,

regardless of ability to pay,” Dr. Jay Kaplan, President of ACEP, said

in a public statement.

“They will continue to shift costs onto patients and medical

providers, as well as shrink the number of doctors available in

plans. Instead of requiring health plans to pay fairly, this ruling

guarantees that insurance companies can pay whatever they want for

emergency care.”

Bundled payments and value-based care gain popularity

Today, healthcare providers are already moving away from the standard

fee-for-service payment model and adopting alternative reimbursement

strategies. The Medicare Access and CHIP Reauthorization Act of 2015

(MACRA) was passed earlier this year and it will also push forward the

advancement of value-based care.

MACRA brings forward more focus on alternative payment models a

nd

performance quality measures, which means payers will begin to

reimburse providers for quality healthcare services instead of merely

the quantity of services provided, as seen with the fee-for-service

payment system.

Additionally, the Centers for Medicare & Medicaid Services (CMS)

are attempting to spread bundled payments throughout various aspects of

the healthcare industry, particularly among joint replacement surgeries.

In an interview with HealthPayerIntelligence.com,

Jeremy Earl, Associate at McDermott Will & Emory, clarified, “From

my perspective, I’m a big believer in the shift away from

fee-for-service payments. Today, you get a critical mass of providers

who are being compensated on whether the care they provide is

cost-effective and high-quality versus just providing more care.”

“The bundled payment demonstration project on a voluntary basis has

been extremely popular with a lot of providers and now they’re rolling

it out to be mandatory. That’s just one example of the program put in

place by the Affordable Care Act transforming how providers are paid.”

No comments :

Post a Comment